Azar Mammadli

Digital Mobile Banking

Redesign digital mobile banking user interface by understanding user needs, current UI shortcomings, and the latest trends in mobile banking design.

UX DESIGN

Create Problem Statement, User Flow Map, Low-Fidelity Map, Wireframing

UI DESIGN

User Interface Design, UI Elements, Hi-Fidelity Map, Prototyping

VISUAL DESIGN

Solve visual problems and make things look visually good

USABILITY TESTING

Prototype tests, First click tests, Design Surveys, Preference Tests, Five Seconds Test

FIGMA

Wireframing, Prototyping, LO, MID, HI-FI Mapping, UI components

MAZE

Usability Test

FIGJAM

Brainstorming, mapping and team collaboration

TEAMS

Interviews, Team meetings

The Problem

In today’s digital banking experience, users often face confusion and frustration when reviewing their transaction history—especially during moments of financial stress. Important contextual details like merchant names, transaction types, and recurring charges are either missing or poorly presented, making it difficult for users to quickly understand their financial activity.

This lack of clarity increases user anxiety, erodes trust in the platform, and leads to a higher volume of support inquiries. For banking institutions, this not only creates operational inefficiencies but also damages long-term user retention and loyalty.

To solve this, we needed to redesign the transaction experience in a way that improves clarity, reduces cognitive load, and empowers users to interpret their financial data with confidence and ease.

Strategy planning

“Add more new features, get more new customers”

To remain competitive in the mobile banking space, it is essential to offer a robust suite of features that meet the evolving expectations of today’s users. Core functionalities such as mobile check deposit, bill pay notifications, in-app loan applications, credit card recommendations, credit limit increase requests, and quick balance views without login are no longer optional—they are baseline expectations.

Advanced features like voice assistants, seamless account transfers, wire transfers, text alerts for rewards, Zelle barcode scanning for money transfers, and the ability to add authorized users directly through the app can significantly enhance user convenience and satisfaction.

As competitors continue to expand their digital offerings, customers are increasingly drawn to platforms that deliver both functionality and innovation. A thoughtfully customized mobile banking app—not just another template-based design—can differentiate your product, build brand loyalty, and attract new users looking for a smarter, more intuitive financial experience..

The experts think about ideal bank tech. We see that experts advise that future banking must be based on five key principles:

Personalization

Confidence

Self-Service

Transparency

Mobile First

Simplicity

Brainstorming

We were brainstorming on the many new features, analyzing them, and looking for something more emotional. Something that will make customers love our online banking, inspire them, and enable them to enjoy and benefit from the experience truly. So we set out to find out what their passions are. Through interviews and poll research, we understood their needs and interests.

GOALS & OBJECTIVES

Goals and Objectives

Ease of Use

Had to create convenient, effective and trusted digital banking

Single System

Had to provide users with single digital system that managing all transactions-and loans

Encouragement

To increase of bank users

What are the customers' expectations from the Mobile Banking App

The FEATURES that they want to see in the new app

Quick View

84%

Notifications

74%

Seamless Transfer

81%

Digital Wallet

93%

Apply Loans

77%

Voice Assistant

93%

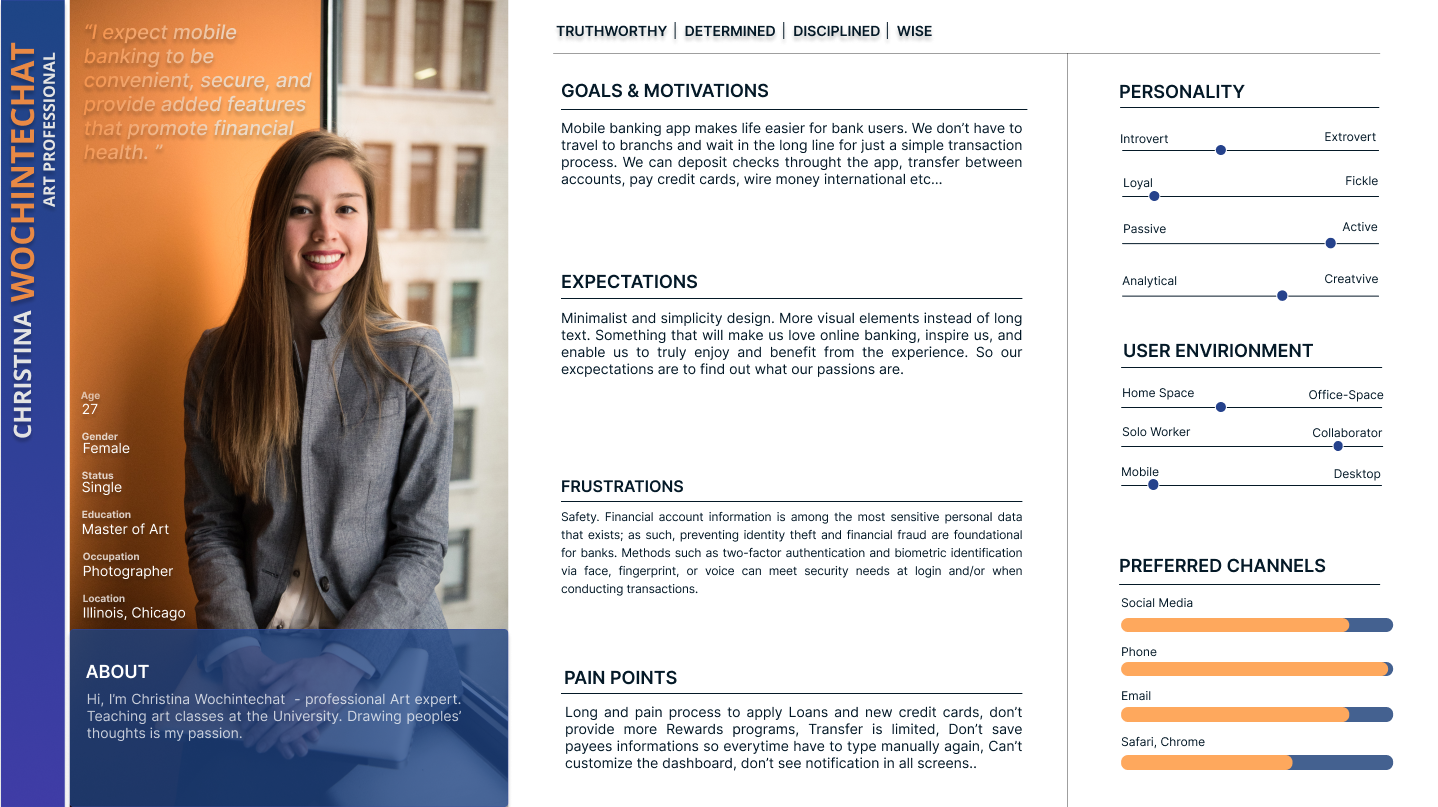

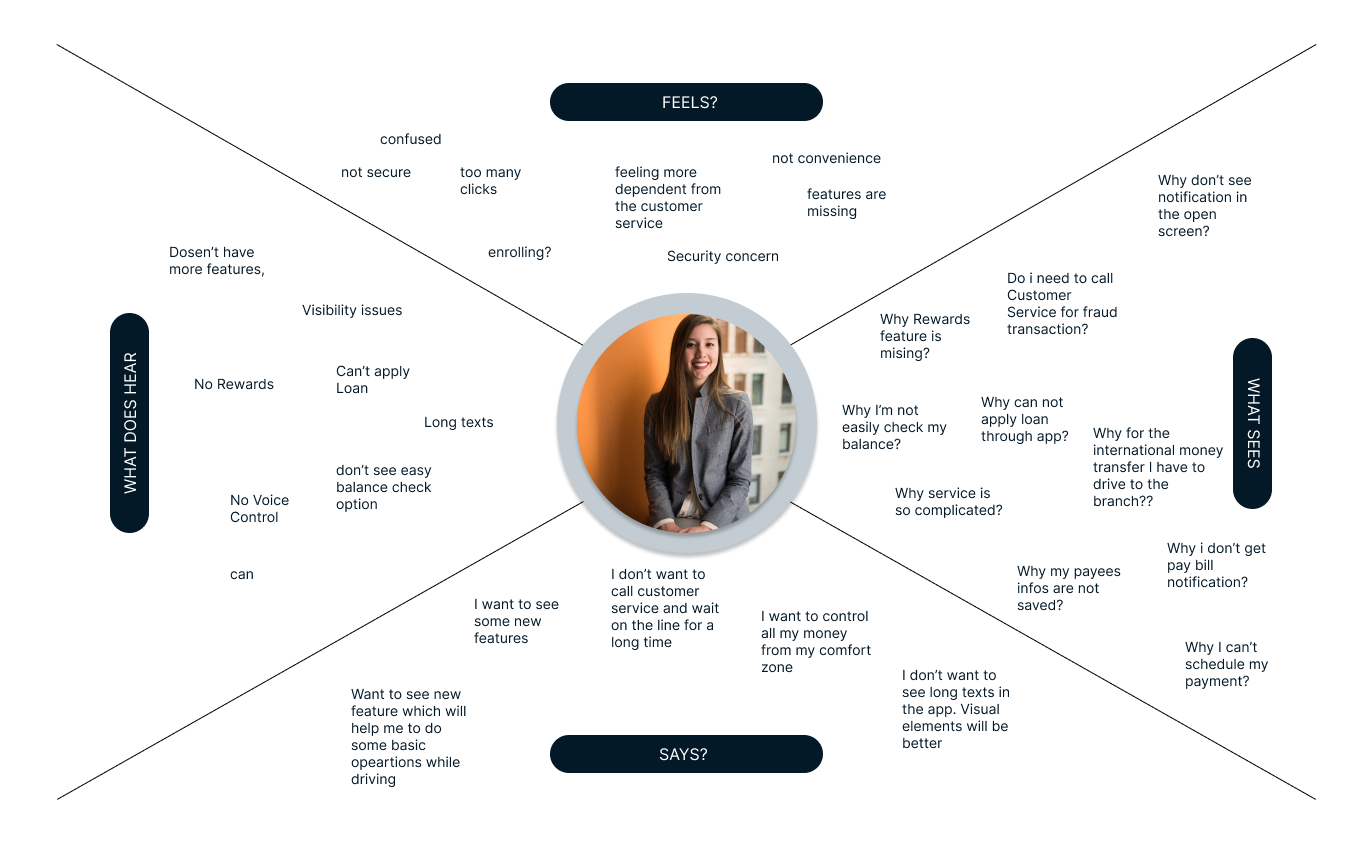

USER PERSONA / EMPATHY MAP

Insights and Takeaways

Identity Theft

About 52% of respondents’ biggest fear is identity theft which can happen in different ways but most commonly with fraudulent emails and text messages

Confidence

About 38% of respondents admitted that a convenient banking application with a simple UX could cause more confidence in the bank.

Digital Wallets

12% of respondents think that digital payments via application are more faster, easier, and generally more sure than traditional payments

New Habbits

To form new financial habits through an app, the interface should replicate patterns of behaviors that are already familiar to the consumers.

Banking as a Service

Banking-as-a-Service (BaaS) platform that provides critical services — such as account servicing, payments, and foreign exchange

Alerts

Most respondents admit that digital bank alerts for unusual account activity, low balances, and large purchases are more valuable.

Loans

Most respondents complain about the long waiting time on the phone to get information about loans. They think that banks need to bring digital solutions for loans.

Safety

Two-step authentication is a standard security measure consumers use when they log into a digital banking account.

New Features

Most respondents admit that new features will reduce customer service dependency.

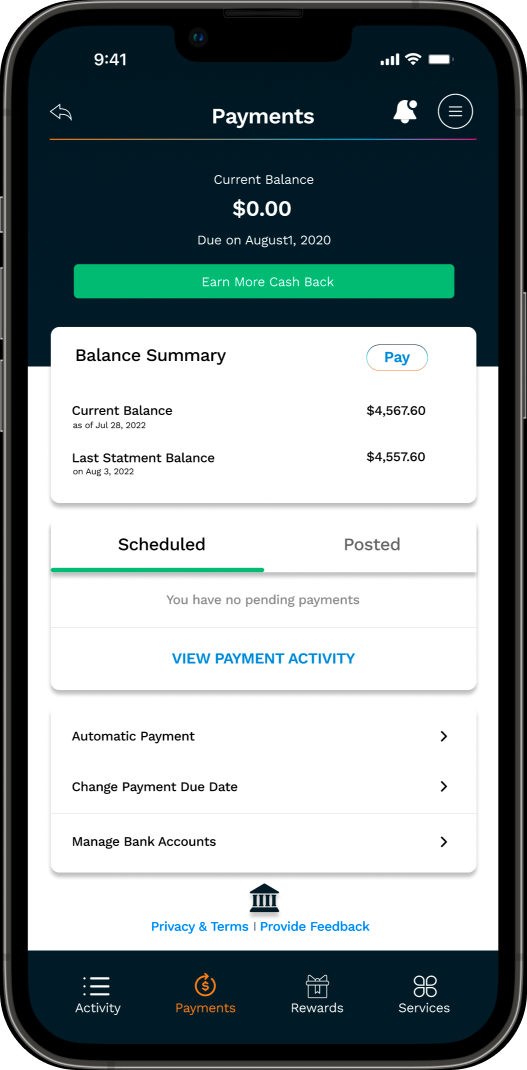

mobile banking app

More features and services via your mobile banking app

Bank users can access new additional banking features, such as applying for a loan or credit card, quick view, voice assistant, etc. via your online banking portal

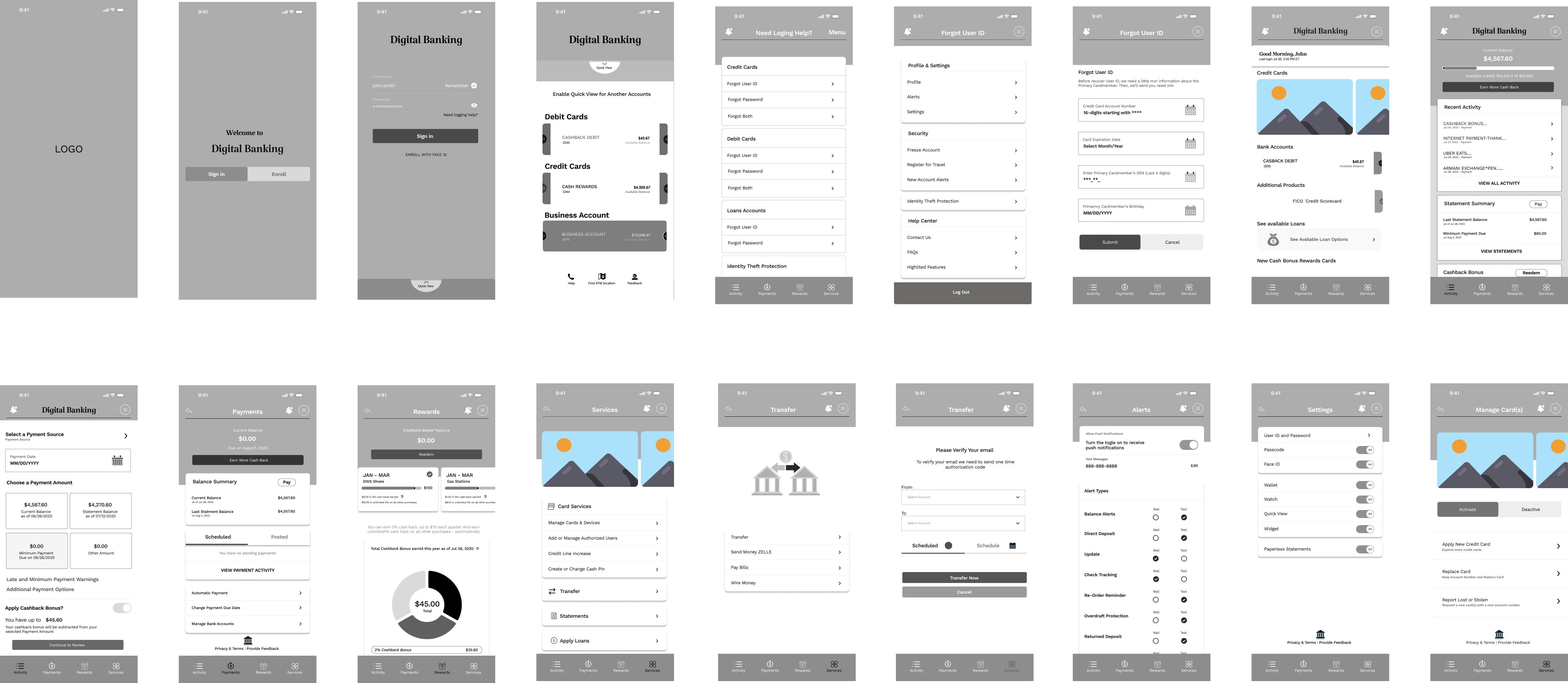

WELCOME TO new digital mobile banking app

menu

Make menu choices as actions.

Avoiding “navigating” menu choices is another excellent UI/UX technique for our banking app. Instead, we should use “doing” menu choices. For example, a “payments” menu that navigates to another screen of other types of payment menus is “navigating,” whereas the “Pay” button that directly leads users to the transaction screen is a “doing” menu.

VOICE ASSIsTANT

Use Voice Assistant Feel Comfortable

Voice controls can allow more people to experience the convenience of banking apps. Voice Assistant gives users more options, which makes banking services more appealing to consumers and businesses alike.

Quick View

Quick View will help customers quickly to see their balance

Displaying the account balance visibly on the home screen without logging in can be very helpful and reassuring for users. Best-of-bread banking applications always allow users to hide their credit from the prying eyes of others. They let users easily hide the balance and related information by tapping on the quick view.

visual cues

Use visual cues and reduce texts.

Most customers prefer natural favor visual cues over long texts. I choose visual cues that illustrate users’ actions; I only choose enough visuals coupled with readers to communicate, not overwhelming users with icons and images.

SERVICE MENU

Offering more digital card services

Offering more flexible digital card self-services to bank customers will reduce their dependency on customer service.

Seee waht our users think and say about the new features

"Quick View" feature is an amazing for us. Now we can easily check the balance and see the payment due date without log in.

Lorena Bake

I loved Bill payment alert. It is one of the best option for us to make a payment in time. Except it we can control all our expenses through the app.

Helen Lori

Great to see "Voice Assistant" feature in the app, which is great to make some transactions via voice while driving. specially senior people..

Adam Brown

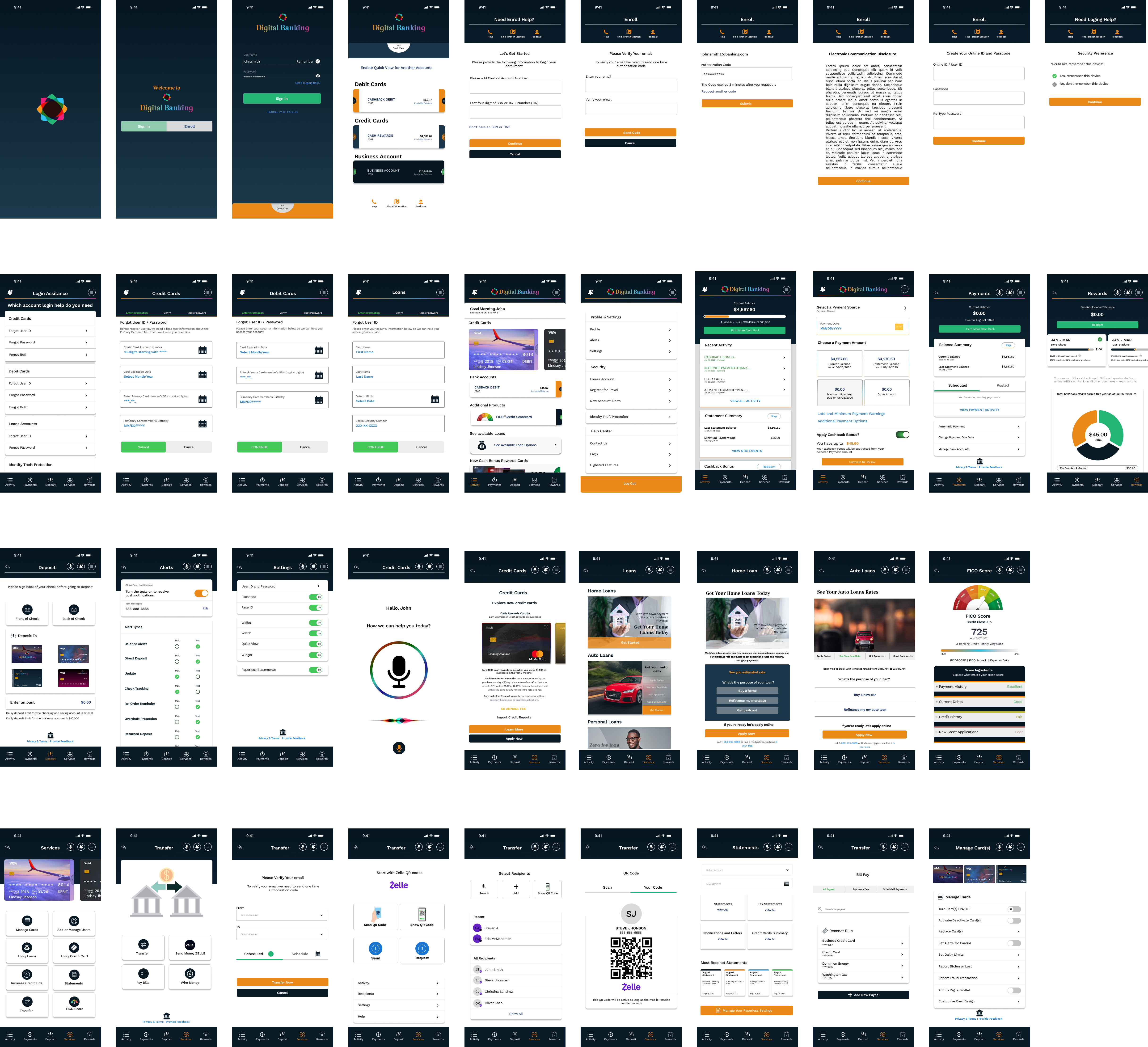

EXPLORE all screens

You can see all screens below

New Features for users